- cross-posted to:

- genzedong@lemmygrad.ml

- cross-posted to:

- genzedong@lemmygrad.ml

I wasn’t going to respond but felt the need to write one because there is so much misinformation about modern monetary theory even among the left, it is driving me insane.

The most important point to note here is that: no, dollar hegemony has nothing to do with how the US can give everyone free healthcare and solve poverty and homelessness. These are two separate concepts that kept getting muddied together by some misinformed concepts like the “petro-dollar” I keep seeing peddled among the anti-imperialist crowd.

To be clear, I am not disagreeing with the anti-imperialist position on the video, and I will discuss why it is difficult for the Global South to implement currency sovereignty, but it is completely wrong to say that the US can only fund its spending because the US dollar is the global reserve currency.

The authority on this subject is Michael Hudson and I implore everyone to read Super-imperialism to understand how dollar hegemony actually works (and it has little to do with petro-dollar, though petro-dollar is one small component of it). This should be essential reading for every leftist by now so people don’t keep regurgitating right wing neoclassical nonsense, like “inflation is only caused by excessive money supply” as mentioned in the video, which is flat out wrong.

Let’s break this down:

Modern monetary theory clarifies a very important concept about fiat money and debt, which is that any government with monetary sovereignty (i.e. currency that is not pegged to gold or any other currency, and has the ability to print its own money e.g. not state/local governments or EU member states) can spend domestically as much as it could without leading to inflation, so long as there are available labor, resources and technology.

(By the way, the USSR under Stalin practically did this which led to unprecedented economic growth and hundreds of new cities that cropped up within a single generation, one that threatened to overtake the US, until Khrushchev complained about the “national debt” being too high and the Soviet government defaulted on its bonds in 1957, which was one of the reasons that led to the stale Soviet economy that followed in the 1960s and 70s and its inevitable downfall in the 80s. Why? Because the Soviet government stopped spending enough to adequately drive its large economy.)

This has nothing to do with dollar hegemony, in which the US dollar as a global reserve currency allows the US government to print as much as it wants to get “free lunch” overseas. Michael Hudson detailed this in his book Super-imperialism: the entire reason it works here is because foreign central banks do not have any other places to utilize/spend the surplus dollars, and so the US treasury bonds acted as a vehicle to absorb these excess dollars spent overseas, thereby allowing the US to keep spending overseas without limits, because all those extra dollars are “recycled” back to the US treasuries and “deleted” there anyway, effectively giving them “free lunch” from the developing world. In other words, foreign countries export their goods and services (made by their own labor and resources) and receive junk papers in return, which are then absorbed by the US treasuries to earn a few % of interests long-term. The recycling process will continue to work until the rest of the world de-dollarize, which is why it is such a main theme when it comes to anti-US imperialism these days.

So, no, the US dollar does not need to be the global reserve currency, nor does it need dollar hegemony to spend domestically to re-industrialize, give full employment for everyone, and provide free healthcare, housing and other public utilities for everyone. It doesn’t need to tax billionaires to pay for its spending, because the US government is itself the currency issuer, why does it need to collect the money it spent in the first place?

The reason that this is not being done is purely political sustained by a right wing economic ideology (the Chicago school) that says, no, the government cannot spend beyond its means, much more than it earns, so we have to administer austerity and cut back social spending and welfare because we owed so much “debt” to China and scaremongering quotes like “our children have to repay our trillions of dollars worth of debt owed to China!!”.

In reality, the $800 billion dollar “national debt” that China “lent” to the US were simply the surplus dollars China earned after exporting goods to the US, and because China runs a trade surplus with the US (after importing from the US, and being prevented from buying up critical American industries), it will always accumulate dollars in the end. So, without any places to use these dollars, they “lent” that money to the US treasuries to earn a few % of interests every year. It’s effectively junk papers for China, which is why China has stopped buying US treasuries ($1.2 trillion down to $800 billion) and spent them on Belt and Road projects instead (which comes with its own problems, but this is beyond the scope of our discussion today).

So, what prevent countries from the Global South from doing that? It is important to understand the neo-colonial history following WWII, during which global institutions were set up to prevent the developing world from attaining their economic sovereignty.

For example, countries borrowed dollar (from the IMF) or pegged their currency to the dollar, for instances, will always be indebted to the dollar and need a dollar reserve to defend their currency. This is actually one of the points the video was correct about.

Furthermore, US imperialism prevented food and energy self-sufficiency in the Global South. With World Bank explicitly demanding the Global South countries to plant export crops rather than prioritizing on food security, and with energy such as oil and gas being sold in US dollar (as you can see, the petro-dollar only plays one part in the entire imperialist process that stifles economic growth in the Global South).

Finally, GATT (the precursor of WTO) forces Global South countries to open up their domestic market for multi-national corporations to enter and to be flooded with cheaper foreign goods, thus devastating their local industries along the process.

All of these factors: high external debt (especially dollar debt), unable to attain food and energy self-sufficiency are what created problems for the Global South countries from fully utilizing their monetary sovereignty. It has nothing to do with needing to be the global reserve currency to spend domestically.

And if you understand all that, then you’d understand why sanctioning Russia was doomed to fail: a country with very low external debt, is fully capable of feeding and providing energy domestically, is very difficult to be conquered with US dollar monetary imperialism. Unfortunately most Global South countries do not have the same condition, and only with full scale de-dollarization can we move past that.

Still, this doesn’t mean the US cannot spend an infinite amount of money to give healthcare and infrastructure to its people. Even if the US loses its dollar hegemony status, it can still do all that as long as they can re-industrialize with adequate labor, resources and technology at home. Don’t fall for the propaganda that you have to tax rich people before the government can give you good stuff - the government can always give you good stuff, they just choose to give it to the rich people instead.

Bonus material:

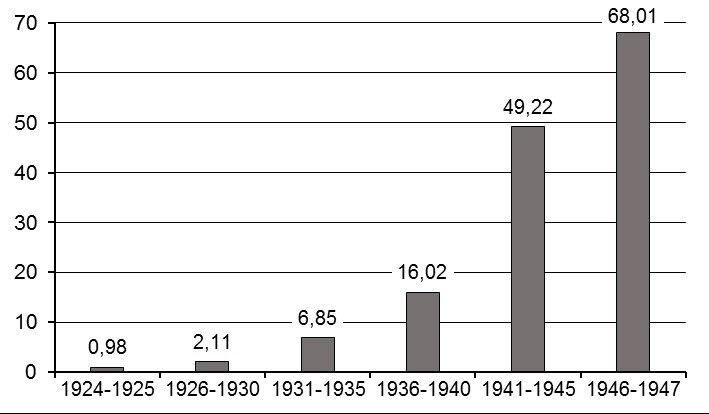

Figure: Average monthly volume of money in circulation in the USSR in various years (trillion rubles)

Source: Central Bank of Russia

As you can see, the exponential increase in spending starting from 1929 coming out of NEP, under the Stalin’s first Five-Year Plan, created the conditions that allowed for the unprecedented growth of the USSR economy.

Please tell me how a government has to spend within its means and tax billionaires in order to lift millions out of poverty into a space-faring nation. The Soviet economy was more or less devastated after the Civil War, who else were they taxing? How else could the USSR win an industrial and military war against Nazi Germany if it had to spend within its means?

With this example, I suppose the video is not necessarily right, but Hudson is still unMarxist and seems to over-complicate things without getting to the roots of labor theory of value and so on.

Your posts about MMT have convinced me to look into for myself. L. Randall Wray has a new edition of Modern Money Theory coming out in April, that book seems to highly regarding so I’m going to check that one out.

I have also read Super Imperialism and want to echo how important it is for leftists to read. However, I would also caution folks who don’t have a solid econ background (and to be honest, even if you do) to allow yourself a lot of time to research stuff on your own as you are reading through it. Otherwise you might find yourself extraordinarily frustrated. Because Hudson really throws you into the deep end and expects you already understand a lot about international economics - which is a notoriously difficult topic. I mean, I recall Hudson calling out Paul Krugman for getting something wrong in an article he wrote (talking about balance of payments only in terms of trade and not govt flows). And while Krugman is wrong about a lot, it’s not like he’s uneducated when it comes to econ. This is complicated stuff but then again no investigation no right to speak.

But for an example, Hudson talks about the pressure the Vietnam war put on the system. But as I’m reading it, I’m confused because in my mind, the war spending is being done domestically by paying American soldiers and weapons manufacturers in the US. Hudson doesn’t explain how and why there was so much spending done in Vietnam/outside of the US, I had to research that myself. A lot of examples like that. Really, I wish Hudson made Super Imperialism to be twice as long and break it up into multiple volumes, and use the extra pages to really explain the details.

Super-imperialism is a difficult read! Took me a few goes to be honest, and every time I still discover new things I never noticed before. I don’t claim to fully comprehend the book, to be honest. It’s one of those books that as your understanding of economics and finance grew, when you re-read them you will learn new details that didn’t make sense before.

The Destiny of Civilization is much more straightforward in comparison, and I recommend it for people who want a simpler version of it (also more up to date with the recent growth of Chinese economy etc.)

Anyway, as for your last part, the US military personnel and all their logistics have to spend the dollars the government paid them overseas, in French Indochina right? That’s how the French banks racked up all those dollars, which were remitted back to the central bank in France because they didn’t know what to do with all those excess dollars.

I find little wrong with this, but I don’t see how it invalidates the video that much, and I’m very skeptical of anything Hudson has to say as he’s more of a Keynesian than a Marxist. That last paragraph is the problematic bit. He makes it sound like capitalism can keep running indefinitely if run well and rich people and common prosperity can co-exist. Hudson doesn’t understand imperialism or the contradictions of capitalism. He says the rentiers and finance capitalists should be regulated out of existence, but they are a product of his favored industrial capitalist and existed back then. He doesn’t understand the inherent decaying nature of capitalism or the tendency for the rate of profit to decline. Capitalist governments need to prop up capital with absurd subsidies or else the system will collapse.

I recommend Socialism or Extinction as it has a strong criticism of “harmonists.”

P.S. I’m only saying all this because I’ve defended Hudson and lost.

From Michael Hudson’s Killing the Host, Ch. 28:

Industry is being financialized more than finance has become industrialized. The remedy is to write down debts and reform the tax system. Our financial problem is like a parasite on a sick body. The host needs to get rid of the intruder before it can heal itself.

Downsizing finance will not, in itself, avert the threatened privatization of the post office, water systems, roads and communication, or cure the high cost of privatized medical insurance and other infrastructure. Once you remove the debt drain and rentier burden from industrial capitalism will still leave the familiar old class tensions between employers and their workers. This will still leave the familiar labor problems of industrial capitalism – the fight to provide fair working conditions and basic necessities to all citizens, as well as to avoid war, environmental pollution and other social strains.

Hudson has never said that the goal is simply to get rid of finance capitalism. Hudson followed the true Marxist fashion of saying that industrial capitalism as envisioned by the classical political economists (Smith, Ricardo) will ultimately end in creating the material conditions necessary for socialism to be achieved.

Hudson is saying that defeating finance capitalism (rentier and landlord class) will pave the way for industrial capitalism to return, which as Marx himself had explained in Capital Vol. 1, will follow the historical process towards socialism.

In other words, Marx brought Smith and Ricardo’s theses to their logical conclusion, using historical and dialectical materialism, and showed that socialism became inevitable under (industrial) capitalism.

That’s silly. So he wants to revert capitalism from its imperialist stage into the one Marx analyzed so Marx’s original vision would be carried out. Hudson said himself the only country close to his ideal industrial capitalism is China, and its socialist. Who is his proposition for, and how does he plan to revert away from imperialism? Also, when has industrial capitalism ever lead to socialism? Socialism has happened in pre and semi capitalist colonies.

???

You’re confusing me. That’s literally Capital, Vol 1.

Lenin explicitly stated in Imperialism: the Highest Stage of Capitalism that imperialism was about the expansion of finance capital.

From Lenin’s Introduction to Bukharin’s Imperialism and Global Economy:

At a certain stage in the development of exchange, at a certain stage in the growth of large-scale production, namely, at the stage that was reached approximately at the end of the nineteenth and the beginning of the twentieth centuries, commodity exchange had created such :in internationalisation of economic relations, and such an internationalisation of capital, accompanied by such a vast increase in large-scale production, that free competition began to be replaced by monopoly. The prevailing types were no longer enterprises freely competing inside the country and through intercourse between countries, but monopoly alliances of entrepreneurs, trusts. The typical ruler of the world became finance capital, a power that is peculiarly mobile and flexible, peculiarly intertwined at home and internationally, peculiarly devoid of individuality and divorced from the immediate processes of production, peculiarly easy to concentrate, a power that has already made peculiarly large strides on the road of concentration, so that literally several hundred billionaires and millionaires hold in their hands the fate of the whole world.

I know what imperialism is lol. I’m saying how the hell do you think you can reverse it rather than simply going through? It is a reactionary and petty bourgeois error to try to reverse the development of capitalism. Answer my question: why is going to a specific past stage of capitalism which had no successful socialist revolutions the best plan of action? We don’t have time for this, the climate clock is ticking.

Great video! MMT is great as a framework for understanding money but I think like this video sorta highlights, the economists developing the theoretical side have gaps that can only really be filled by a Marxian interpretation.

I agree. Unfortunately, it seems like the MMT theorists that want to support socialism don’t understand understand Marxism, but use a Keynesian framework instead (Micheal Hudson and others), and then there are some (from what I’ve heard on an episode of Macro N Cheese) that want to turn away from Hegel toward Kant and totally redefine socialism. Sadly most of these people are trying to explain and support China, which is annoying when they can explain themselves through Marxism without distorting it.

Anyway, this is the best evaluation of MMT I’ve seen beyond random Lemmygrad users. Although, I don’t think Fellow Traveler actually supports China.

To clarify, MMT is not Keynesian, and not even post-Keynesian. The key figures that influenced the MMT development (Minsky, Hudson, Mitchell) were/are Marxists.

Keynes proposed government stimulus (deficit spending) only during crisis of capitalism, and fully supported right-wing austerity when the economy is going well. MMT says that the government should run a perpetual deficit spending program to drive the economy. That’s the key difference between Keynesianism and MMT.

I’m aware there’s a difference. Hudson’s just all over the place. The other day I was listening to him and Radhika Desai and he started using Georgist talking points and then suggesting that Capitalism has fallen to feudalism with the “rentier takeover.”

Yeah strange to focus on analyzing China instead of the major imperialist and global hegemon, although I guess there’s way less of an audience for that when you live under it.

My impression is they’re like “here’s some problems with the US economy, here’s what a country like China (and Japan and Germany???) are doing right. Let’s imagine they’re the same kind of economy and they could reform into each other or be copied by the global south.” They’re not very Marxist.

Good video. When I was in school every econ teacher would tell us that the fed printing money was going to cause inflation, and year after year of no inflation they could never give a good answer as to why it wasn’t happening. This really succinctly explains that so long as exploited countries are reliant on capital infusions and dollar pegging, the dollar isn’t going to weaken.

I do like the summary at the end about social chauvinism. So many times I talk with people that I think are on the same wavelength before discovering they’re not upset about the thieving, just the way the spoils are divided.

I found a YouTube link in your post. Here are links to the same video on alternative frontends that protect your privacy: