Polling the community here. Please share your experience with pet insurance providers in the USA. The good, the bad and the in-between. If not from the USA, please list the country.

Do they accept older cats? Recently adopted cats from a shelter? Preexisting conditions? How much is the premium? Etc.

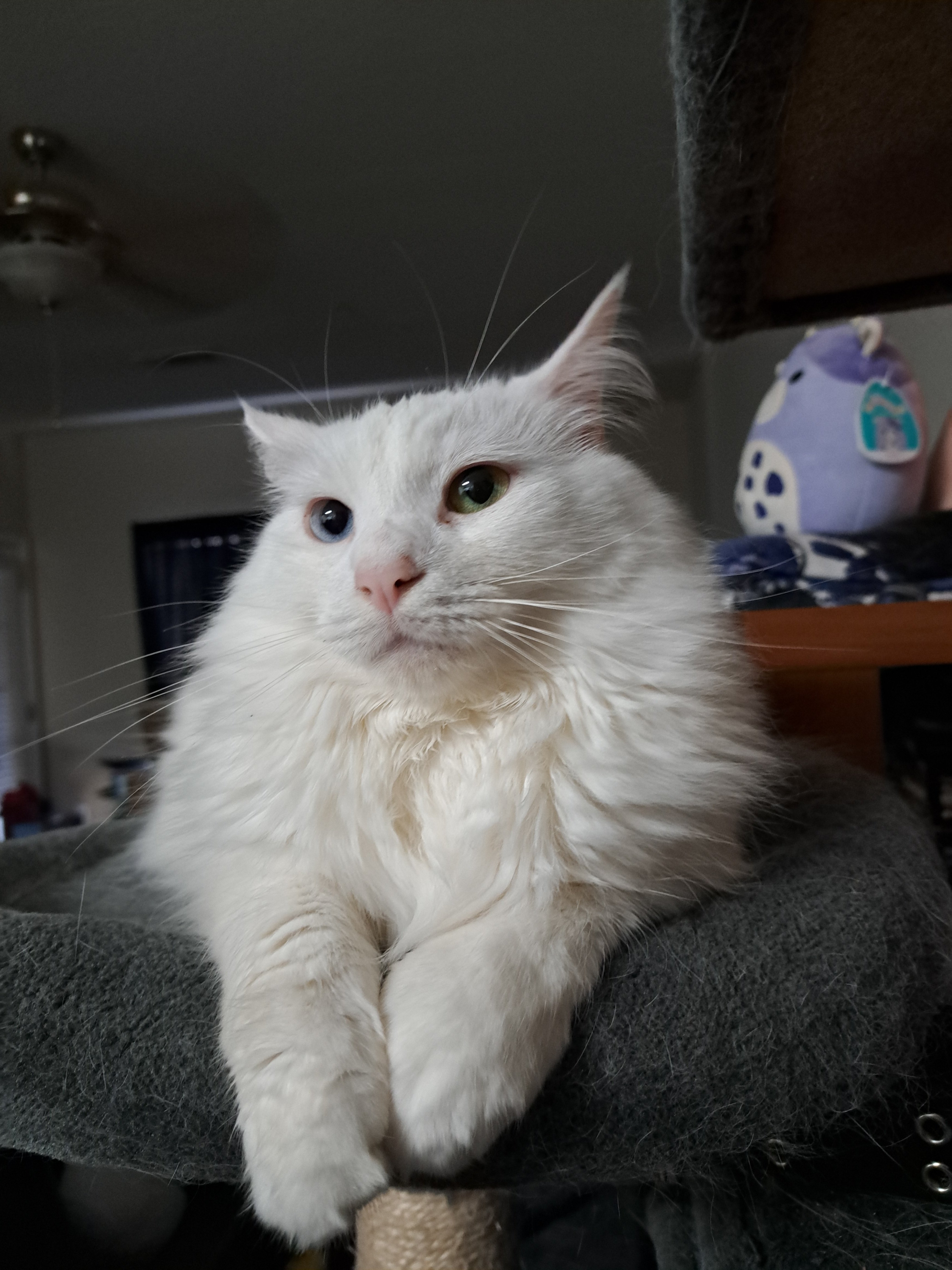

sorry, i cound’t help myself:

- Furdelity Life

- PetLife

- Mew York Life

- Purrudential Life Insurance

- Meowtual of Omaha

- Furrmers Life Insurance

- Allstate Catastrophe Insurance

- Nationwide Purr Insurance

bored at work :P

I have it through ASPCA and it’s been a god send. Not having to worry about any tests or procedures, just being able to say “yes! What ever she needs, do it!!” My kitty had some pretty serious health issues, so I really used it.

$10k per year for $70 a month, plus all the preventative stuff like dental cleanings and shots.

I pay full cost and they reimburse 90%. I haven’t had any claims rejected; rx food, labs, meds, eye doctor, fucking cat acupuncturist.I can’t imagine the heart break of having to just put your beloved down because of the cost of life saving procedures.

My job offers subsidized pet insurance as a perk, and even then, the monthly fees are so prohibitively expensive for my cat that it would be a financial mistake to pay for insurance rather than save the money and use my savings in an emergency. Not to mention that I’d have to with insurance anyway, since the premiums were so high.

As a rule, non-essential insurance (including pet insurance) is designed to be a losing bet as you are paying for the average cost of an insured animal’s care, plus the overhead of hundreds of people’s wages.

The only reason I could see you paying for it is if you know your pet will absolutely need it in the future and it will pay for itself, in which case I would use insurance with the smallest premium. Best of luck.

As a rule, non-essential insurance (including pet insurance) is designed to be a losing bet as you are paying for the average cost of an insured animal’s care, plus the overhead of hundreds of people’s wages.

Plus all the other business overhead, plus tidy shareholder profits.

I will say that over the lifetime of my two cats so far (one died last August, the other is now 13y old), the insurance paid less than if I had just saved up the money and paid it myself, and by quite a margin.

It depends on whether you can do that, however. On average you’ll save money by paying it yourself, but you need to be in a situation where you can have the cushion of money around to finance cat surgeries and dental work and so on.

I strongly disagree with the people who say pet insurance is prohibitively expensive.

We pay around 120 per month for both of our cats and it has paid for itself several times over. When we had 4 cats, it was under $200 per month.

One emergency surgery can be over $5,000.

Dental issues can be extremely costly.

We had a cat with chronic allergies. Insurance covered his ongoing immunotherapy treatments which were over $100 per month.

We had a cat with cancer who had over $10k in treatments and surgeries covered in less than a year.

I strongly, strongly recommend you get quotes from a couple reputable providers. We have been very happy with trupanion.

Then, call your vet and ask how much surgery for an abscess, tooth extraction, cancer treatment, or broken leg is. Then ask how much an ultrasound is.

We have saved thousands of dollars over the years with pet insurance.

Mine just covered thousands of dollars for my little dude, sadly only the beginning of the finances of it.

Here’s my recollection from my limited research on this a few years ago (in the US):

-High premiums

-Insurance company can cancel coverage or jack up premiums if your pet becomes expensive

-needing pre approval for coverage, so you may be dealing with an extra layer of beurocracy when you need to get your pet treated

-Notable risk of insurance company rejecting claims

-Maximumum coverage seemed rather low (ie they cap the amount insurance will pay per year or lifetime, so your coverage may dissolve if you end up having serious pet health issues.

-high copays, so you’re still paying a lot in the event of large vet expenses.

Basically, overall, it seemed like a scam in which, even for those that end up needing a large amount of vet care, you are likely to get less benefit from insurance than premiums.

All that said, I don’t think I did much research. I think I looked at a couple of pet insurance companies that seemed “legitimate”, looked at the details of their policies, did some math, and concluded “lol, fuck no!”

We have Nationwide for our dog. They’re pretty good except they don’t cover pre-existing conditions or prescription food. They pay for her annual dental cleaning which more than justifies the monthly payments. We do get a 5% discount through my husband’s employer. It might not be worth the cost for an older pet with lots of pre-existing conditions but I’d absolutely do it for a younger pet, the earlier the better.

This is kind of long, but hopefully it’ll help you out.

I’ve used Healthy Paws, and I currently have Embrace.

I was very happy with Healthy Paws. I did a ton of research before going with it. I adopted a 6-month-old kitten, and it turned out he had a congenital heart defect. I got him the best care from the best local cardiologists. He lived a relatively long, happy, pain-free life. And I got back MANY thousands of dollars over the years. Not once did they ever give me any hassle. The app was great. The customer service was excellent, and everyone I talked to on the phone was very knowledgeable. Plus, they were all animal people, so they always seemed happy I was getting him good care.

Unlike most pet insurances, Healthy Paws has no annual maximum. Because of that, over the years, as he got older, premiums started to go up significantly. I still got back way more than I paid into it.

Now, I have a different cat. I got him when he was tiny, and I went with Embrace. I’d heard great things about Embrace, and because it has a $1500/year cap, premiums don’t increase quite as much as with Healthy Paws. (And in the past, I’d never come close to spending that much in over year.)

And my cat has an autoimmune condition. (What’re the odds I’d have two on a row with big medical bills?)

Embrace is good, but it’s not AS good as Healthy Paws was.

The Embrace app is just okay, though it works most of the time. Customer service is just a little less knowledgeable. I had trouble with one of his early claims - but only with that one claim. For example, he just had a $5000 set of biopsies, and I expect to get 90% of it back.

If I had to do it again, would I have stuck with Healthy Paws? I don’t know, honestly. I miss their customer service, but I know it would’ve cost more over time.

I used to work for a major insurance company, so I understand how insurance works. I’m a fringe case, most folks won’t make as many expensive claims as I have. And I happily pay to insure my other cat, too, even though I’ve never had to file one claim for her.

Happy to answer more specifics about the plans, too, if it’d help you.

Checkout Lemonade. The premium is relatively reasonable, and the yearly limit is like 100k if I remember correctly.

Older cats might be excluded.

Preexisting conditions are excluded.

Recently adopted would be fine and likely easier to insure because you don’t know their medical history.

Try on c/USA