Pretty much title. I’ve seen this talked about a lot but I only very vaguely know what all this means, could someone elaborate on what happened, why it happened and what the consequences of it are?

The company I worked for was a VC backed startup and they used the phrase: no more free money, to let us know we were let go. A lot of governments kept interest artificially low to ward of a recession (causing our current one) before and during covid. With this low interest rate people (more likely companies) were able to borrow money from the banks with no or even negative interest. Thus the idea of free money, as long as you invest and don’t lose it you can use that money to “make” more money.

Now with the interest rates rising this is a lot riskier, and VCs and companies are less eager to invest.

Let me know if this cleared it up 😁

Yep.

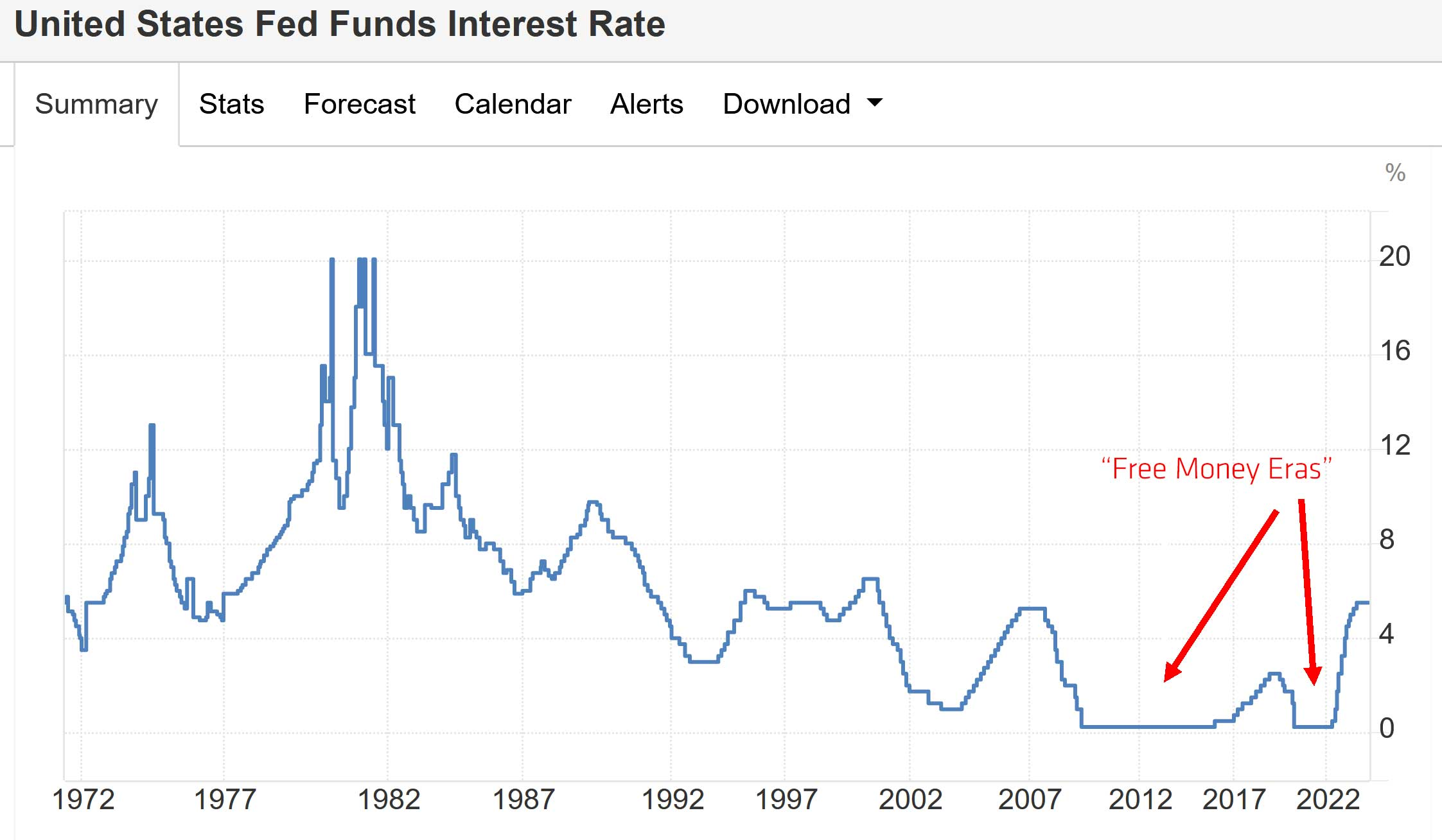

Companies were borrowing massive amounts of money at interest rates that could be fractions of a percent, which meant all they needed to do was find a way to exceed that via investing and they had free revenue. LIBOR, which is what dictates interest rates in most of the West, was around half a percent from 2010-2020 (excepting 2017-2019), now it’s at 5.5.

In addition to that, a lot of companies were using it to finance stock buybacks, which would increase per share metrics like raw earnings per share, while also inflating stock price due to there now being fewer shares outstanding, which of course artificially inflates the way your corporation’s finances look; they could also be compensating their executives in stock options, which now likely had the added ‘incidental’ benefit of being worth more. But of course, they were only doing buybacks to pass earnings on to shareholders, certainly not to enrich themselves.

I feel compelled to mention this is all perfectly legal as long as these things are disclosed within the appropriate timeframe, but it (obviously) should not be. We can thank Reagan for legalizing buybacks, and we can thank Clinton for fucking up how they legislated limiting executive compensation (whether it was intentional or not is up to you).

All investment banking, VC firms, hedge funds, and other financial ghouls and goblins live and die depending on the interest rate set by the US Federal Reserve. When it’s low, everyone can borrow for cheap, and if you have an investment opportunity you are much more likely to make your money back since you don’t have as high of a wall to surpass to make profit. When it’s high, consumption slows down because it’s less likely for investments to be profitable.

In case of “no more free money” that phrase is commonly used to talk about VC firms that make very unwise investments that are highly unlikely to make money back, but interest rates are low enough that they don’t care as long as one or two of the companies they invest in shoot up in value. Raise the interest rate and it’s bad news for all the techbros making dog dating apps and hoping to catch a golden parachute from VCs who were, previously, mathematically losing money by thinking it twice before they gave you millions of dollars. This isn’t just a big deal for startups, it also is bad news higher up in companies that need big investment to keep growing (AKA all companies) so a drastic hike in interest rate can lead to layoffs.

as others are saying in the other posts, it’s about the cost to borrow money or the “time value of money” (cash in hand today is worth more than the promise of cash later). these are central features of a capitalist system: the notion that money must move and generate value, that lenders should charge interest. these ideas existed in eras prior to the capitalist mode of production, but under capitalism, especially neoliberal capitalism, there is no jubilee/forgiveness or moral constraints on lenders accumulating great wealth.

under US capitalism, the central bank (US federal reserve) is independent of any democratic control (it is a private entity) that sets the federal interest rate. this is the rate at which large, commercial banks can borrow money from the federal reserve. commercial banks make money by loaning money to private individuals, companies, etc and then charging interest. the interest rate the commercial bank charges will be higher than the rate of interest the commercial bank pays to the central bank so the commercial bank can turn a profit. so the central bank rate sets the pace for how much interest is charged to borrow money (i.e. how much it “costs”) in the broader economy.

Here’s an image of “historic” interest rates with callouts for when bozos like me are referring to “free money” times.

the most common activity this affects is buying a car or a home, because normal people don’t carry around like $20k for a car or $200k in a bank account. so if you bought a house in 2021, had great credit, and a good down payment, and the term of the loan was 30 years, your interest rate was probably like 2.75%. if you bought a house today, with the same everything, the interest rate might be 6%.

the difference between those two rates over 30 years is stark. to make the math simple, maybe in both cases, you only needed to borrow $100k to buy the house. at the lower rate, over 30 years the payback on the loan would be $146,966.83 [borrowing $100k would “cost” you $46,966.83 in interest over 30 years]. at the higher rate, the payback on the loan would be $215,838.19 [borrowing $100k would “cost” you $115,838.19 in interest over 30 years].

I think it’s worth pointing out the difference in monthly payments for the loans in your example, those payments would be $408.24 at 2.75% interest and $599.55 at 6% (the payback amount divided by 360 months). So a higher interest rate means people have to pay more for housing.

Whenever you borrow money from a lender, you must pay it back with interest. The percentage of the borrowed amount that must be paid back with the negotiated time period is the interest rate. Banks lend money to people and companies. Banks also lend money to one another. The rate of interest that banks can charge one another is set by the a committee that’s part of the federal reserve. They meet eight times a year to set a target interest rate on the biggest lenders. This is to adjust how fast the economy is growing. Low rates means these banks exchange more money more often because it costs them less interest to do so. Higher interest means they’re more picky about lending.

The way the biggest lenders exchange with one another has an effect on the smaller banks and lenders. Ultimately, the money comes from the top, where money is exchanged and managed with the federal reserve system.

When those interest rates are very low, money moves easily and faster. Any borrower is more likely to take advantage of a lower interest rate, the money they are borrowing is cheaper in terms of debt service cost. When interest rates are very high, the opposite happens. Borrowers can’t afford to borrow and lenders don’t have as much capital to lend.

For a little bit of time in recent history, interest rates were historically low. Large companies and banks could borrow money for very little interest. This is why there was a startup boom in silicone valley. A venture capitalist firm could easily borrow money to fund any project they thought could work. It also helps with borrowing money for things like construction. You get increased real estate construction with low interest rates.

When the federal reserve started targeting higher rates, due to inflation, the banks were spoiled on low rates. It was a shock to people because many had spent most of their career having easily accessible capital. Now it suddenly became an issue because you interest payments on $100M became a lot more expensive. Even though rates are still reasonable compared to historical rates, people still freaked out.

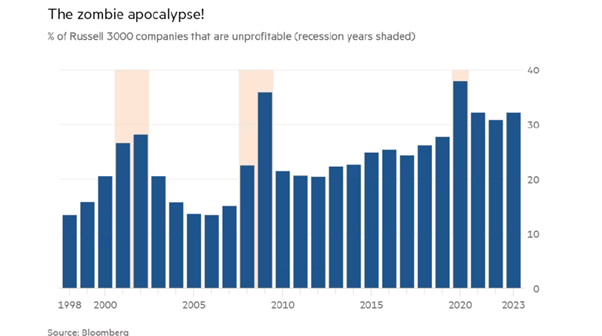

Also important to note: 30 percent of US firms are zombie firms

A zombie firm is one that only makes enough money to service their debt but not to pay it down, and so are stuck staggering onward in an undead fashion. During the period in which there was ‘free money’ (low interest rates), these companies could go on as their debt repayments were not too harsh, and some could even continue borrowing more credit to use for servicing previous debt.

If this sounds insane that’s because it is. Estimates are that a third of US firms rely on essentially a quicksand base of debt, and their profitability is not growing enough to cover their debts. The federal reserve, as the guardians of American capital and firm believers in the Philips curve, recognise the interest rate as the only tool available to guide the economy.

Meaning they are caught between keeping rates too low to properly deal with the debt bubble, or to raise them high enough to cause a shock that will wipe out much of the debt and much of the economy with it. For now it seems that a total crash is being avoided, but for how long who knows

Private equity (with the help of the private banks (which control the Federal Reserve by design)) is stripping the copper from the walls of the US.

If I borrow $1,000,000 at 0% interest at 3% inflation and put it in an inflation-proof investment (like housing), in 30 years it would be worth $2.5 mil. The ‘real’ interest rate is negative, it’s free money.

Plenty of answers that explain it, but I still thought of a sick ass metaphor. Imagine two farmers, one of them inherits a set of rusty old tools. They till the land and they manage to make 100 potatoes in the season off the sweat of their brow. The second farmer takes a $1,000,000 dollar loan. They get a massive patch of land, people to till it, an irrigation system, etc. and manages to make 1,000,000,000 potatoes. They then pay off the million dollar loan and has 500,000,000 potatoes left over in the same amount of time (they often skip paying off the loan). The second farmer then takes out another loan, but this time they demonstrate their business model and that way they command a much bigger loan of $1,000,000,000 instead. The speed at which you can grow your company depends on how much money you can borrow. Getting a loan simply means that you can produce shit much faster to the point of economic relevance.

If you keep doing this and you have finite resources, you end up with problems. Both you as the farmer and an engineer need copper tubing: you for your irrigation and the engineer for their hadron collider. As a result, paintball guns end up costing $50,000 a pop because they require copper tubing of which there just isn’t enough to go around. Therefore all the dudes who rock at your office start leaving to go work for a farm which commands higher wages so they can get paintball guns. Suddenly the offices are suffering and we need office workers and basically shit’s out of whack.

Therefore, the government and not really the government (the fed) go “you need to chill out, we’re not loaning money this easily anymore.” So the terms on these million and billion dollar loans go from like 7% yearly interest to like 7.5% and it means that the calculus for businesses no longer works. The second farmer who ended up making 1,000,000,000,000 potatoes a year suddenly needs to lay off 80% of their workforce who were getting big salaries due to the cheap money. Only if you’re really, really sure that you have a good opportunity do you seek a business loan during a rate hike. So then people go back to their offices and only the sick ass innovations actually follow through instead of the explosion of volatile ideas trying and failing.

Communism will win

When you get a loan they are now more expensive. You pay more dollars in interest for the money now.

Removed by mod

So the main way the US government “creates” money is by loaning money to banks who then loan that money to other banks, businesses, and individuals. Those banks have to pay interest to the government, and then charge their customers a higher interest rate and pocket the difference.

If the government charges those banks a very low/no interest rate, they can loan that money out at lower interest rates and for riskier ventures because it’s easier to make their money back. At the individual level this means easier to get mortgages with better terms, at the business level it means easier to get funding to start a new business or keep your existing one afloat. If the interest rate goes up, it becomes harder to make your money back, so every level gets stingier and more risk averse.

When you take a loan from a bank, the interest you have to pay is (some constant dependent on the bank and the loan and how risky they think you are to invest in) % + (variable reference rate like Libor) %. This variable part is calculated from how expensive it would be for a bank to borrow from all other banks, but is in often in practice controlled by some central bank. It can even be negative. The lower the reference rate is, the more profitable it is to loan money to invest.