The upper management is scapegoating the workers for their mistakes

You would think that they would move hard to make sure they were hiring the best and more people to ensure bullshit like FRYING THE ONLY COMPONENT PEOPLE WANT FROM YOU BY USING YOUR PRODUCT NORMALLY would be paramount. But no. Fire everyone but the C-Suit, do some stock buybacks, ???, then profit.

Line must go up.

I swear to god if companies don’t realize that the point is to make a product or service that people want to use, I’m gonna sue them in Texas and hope to finally get the corporate death penalty.

That’s the Jack Welch playbook!

I don’t think that’s scapegoating, that’s just cutting costs (which they are great at, judging by the quality of their CPUs)

If it were a sane world I’d be worried about my Intel stock but investors seem to get hard-ons at news of layoffs so it’ll probably go up.

Layoffs always make financial numbers look good for a moment. People are expensive.

It’s cute that you think shareholders actually drive stock prices.

Make your point without being demeaning

Removed by mod

Removed by mod

Stock prices are absolutely determined by investors. As in, that’s the only thing that matters. If more people are selling than buying, line go down. If more are buying than selling, line go up. That’s how it works.

You say “shareholders,” but that’s not accurate. the OP said “investors,” which can mean everything from long-term shareholders to day-traders throwing around options. The former doesn’t determine share prices, those who actively trade the stock do.

Honest question as I’ve been pondering this (and not my orb 😞) recently and I’m not sure if my reasoning makes sense.

You mentioned day-traders making option plays. I can see how that could be used as a signal by the rest of the stock market. Does that have a bigger impact than, for a lack of a better term, mega investors? I’m not a huge investor. My holdings are primarily in ETFs. But I have some money in my portfolio to play around with.

To me it seems like my stocks are affected more by what berkshire hathaway does for example than actual consumer/investor sentiment. To the point where I’m wondering if unless we band together, like GME, we are primarily along for the ride. All while massive firms, insurance companies, tech companies and other large holdings managed by small number of individuals impact stock price a lot more and with that don’t have an insensitive to sell holdings they bet big on.

It’s a little from column A and a little from column B.

berkshire hathaway

Berkshire Hathaway are value investors, meaning they buy stocks based on longer-term value. So if they buy a stock, that doesn’t indicate that they think the stock will go up in the next month or even year, but that they think it’s selling for a good price relative to earnings. In many cases, they’ll completely buy a company (e.g. GEICO) because they think it’ll perform better under their direction than just owning some shares. Also, Berkshire is rarely looking for the best returns (e.g. moonshots that pay out), they’re looking for consistent, competitive performance. For example, Berskshire Hathaway doesn’t own any Tesla stock because it’s too expensive relative to earnings and they don’t know where it’ll be in 5-10 years (whereas something like Coca-Cola is more predictable).

Since they’re not frequent traders, they’re not really that involved in setting prices. However, they’ve had very consistent performance, so a lot of investors make investment choices based on how they invest.

managed by small number of individuals

The thing is, those individuals have competing interests. Some are in it for short-term gains (many hedge funds), some are in it for income generation (dividend-heavy mutual funds), and some are in it for long-term, steady growth (Berkshire Hathaway). And there’s a lot of competition within each group, especially hedge funds, where they’re trying to snap up customers by comparing themselves to their competition.

Prices aren’t set intentionally by some cabal, they’re set by this competition where one group thinks they understand the companies and market sentiment better than another, so they’ll bet against each other and the net result is the stock price.

day-traders making option plays

There are two types of day-traders, there’s the individual investor controlling somewhere between $100k and a few million, and then there are hedge funds that control hundreds of millions if not billions of dollars. The first group is much larger (in terms of people), and the second group is generally more influential because capital is more concentrated.

Here’s a breakdown of who is trading.

Liquidity (i.e. trades):

- 30% - “naturals” - this is direct stock trading, like from hedge funds, individuals, pensions, etc

- 7.7% - hedge funds

- 6.4% - individuals/households

- 5.3% - mutual funds

- 5.1% - pension cash flows

- 70% - “intermediaries” - banks, options, futures, etc

- 18.6% - wholesalers - largely off-market trades, like 401k custodians moving money from the company to the broker

- 16.2% - market makers - often brokers that post simultaneous buy and sell orders to both increase liquidity (availability of shares) and profit from the bid/ask spread

Ownership of the stock market (as of 2019):

- 34% - households

- 22% - mutual funds

- 16% - foreign investors

- 11% - pensions and gov’t retirement funds

- 6% - ETFs

- 4% - business holdings

- 3% - hedge funds

- 3% - other

So, from these we can see that households (you and me) control the biggest share of the market, but we do a relatively small fraction of the trading. So if retail investors (you and me) band together, we can manipulate share prices, like what happened with GME. And you don’t need everyone to band together, you just need enough people to push demand for a stock higher than what other investors expect, and you’ll get a bandwagoning effect (e.g. day traders, bots, etc all thinking there’s a reason for the stock to move). GME started because retail investors at /r/wallstreetbets wanted to stick it to short sellers (in many cases hedge funds who thought the stock would go down, so sold shares they didn’t have), so they pumped the stock to screw those groups over (short sellers have to repurchase at some point…).

massive firms, insurance companies, tech companies and other large holdings managed by small number of individuals impact stock price a lot more and with that don’t have an insensitive to sell holdings they bet big on.

They’ll sell if they think their money is better invested somewhere else. Berkshire Hathaway just sold a bunch of Apple stock to free up capital for other opportunities, even though Warren Buffett still likes Apple (makes up >40% of Berkshire’s portfolio).

I think a lot of people worry too much about these “mega investors,” but at the end of the day, there’s not really any kind of collusion. The SEC shuts down whatever collusion there is, and it’s usually pretty small (e.g. in the millions, not billions, and the global stock market is $100T+).

The groups with the most sway over short-term stock movements are those who trade the most, and that’s mostly hedge funds and mutual funds. However, longer-term stock movements are more impacted by the quiet majority who buy and hold, because that produces more demand for underpriced stocks and less demand for overpriced stocks, just by virtue of market cap weighting.

At the end of the day, a stock price tends to reflect the future expected value of the company, not the current value of the company (i.e. book value). That’s because buying stocks is a mixture of finance (calculating book value + expected growth) and psychology (market sentiment for the company’s products). If a company goes bankrupt, it doesn’t matter how much collusion there is to pump the stock price, those shares will go to zero.

My holdings are primarily in ETFs

And mine are almost entirely index mutual funds (VTSAX and VTIAX and equivalents).

I enjoy looking at market trading, but the statistics show that, long-term, index funds beat active trading, and it’s not even close. All of these active trades by hedge funds and active mutual funds may have the biggest impact on prices, but they don’t seem to have consistent, long-term impact on profits, so it’s honestly better IMO to leave the active trading and stock price setting to these funds instead of getting involved as retail investors.

Not who you were replying to, but very good explanation and interesting read!

- 30% - “naturals” - this is direct stock trading, like from hedge funds, individuals, pensions, etc

Those companies are out to make as much money as possible, and I think the simplest explanation is they’re just better at predicting what a stock will do than just one person.

They may well have an entire team of people studying one company, to work out if they are worth investing in.

As for the options guys, anyone taking what they’re doing as gospel is an idiot, there are some spectacular examples on Wallstreetbets of people losing a fortune on options.

Those companies are out to make as much money as possible, and I think the simplest explanation is they’re just better at predicting what a stock will do than just one person.

You’d think.

They mostly don’t really beat the market long term though.

Hedge funds and short sellers control prices. And they cheat.

Those are investors.

This isn’t a retort, and I don’t think short sellers are investors?

It is a retort.

Hedge funds do invest in stocks. On what planet are they not investors? They invest.

Short sellers are certainly a bit more ambiguous in how you’d classify them - but at the end of the day they’re still buying and selling stocks, and therefore investing and divesting. Classify them how you wish.

It’s also true that short positions only make up a small amount of the market.

Saying that there’s no such thing as investors or that stock prices aren’t influenced by the buying and selling of stocks is insane. That’s ultimately the only thing that influences them.

Plus, short sellers make money when the price goes down. If they’re not classified as investors, then who is ever making the price go up?

Retail orders don’t hit the lot market, they’re internalized by market makers

So, what does drive stock prices?

The FREE MARKET™

I mean, unironically basically yeah. Though said market in his case is made up entirely of investors/shareholders lol

Its free only in the name. Like us. We’re „free” to work or die.

I honestly thought this was about to be another orb post from the thumbnail.

Wanting to ponder, huh. Me too.

I’d hate to be named Jobs, working at Intel. 🔪

Especially if you’re the only one

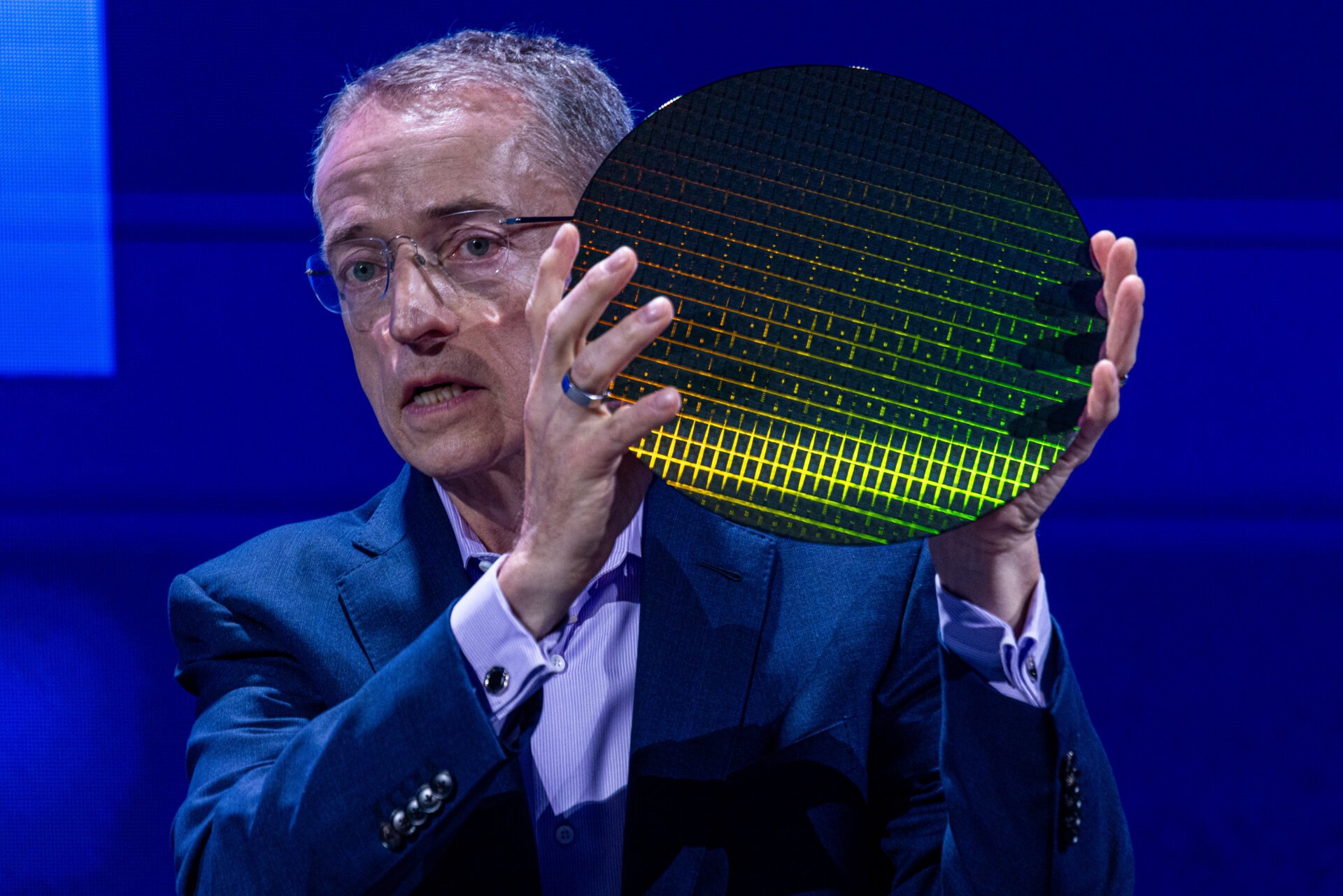

Guys, i’m sorry to say that 15 years of avoiding innovation because we were the market share leader has to end. We thought AMD was a joke after so many issues in the 00’s so we got complacent.

So we have to can all of you marketers who are shitposting on our advertising “review” site and hire some R&D people. Maybe we can scalp some from AMD.

Sincerely, Intel Executives

sounds good, lets_eat_grandma

I guess he likes his roast beef well aged. lol

But yeah, Intel is a company that only innovates when they have to. If it wasnt for AMD they’d probably only produce a new CPU every 2-3 years to save on R&D costs.

Isn’t it essentially Intel’s fault that instead of moving to automated fab configuration, they kicked back and let TSMC get most of the world’s capacity for these new generation fabs, right on top of a geopolitical faultline? Another example of corporate decisions by near-monopolies harming the national interest.

Hell, in this case the global interest, the problems with these corporate decisions and monopolies can cause major issues for pretty much everyone.

Extra mayo!!!

All those fab workers didn’t make a mistake, the executives did.

Government handouts need to come with some extremely strict rules attached. Alas, our government has been purchased by capitalists, so it will continue to be free money but only for the people who need it least.

They shouldn’t be handouts, they should be share purchases. You want Uncle Sam to deus ex machina your greedy ass? Sure, but Uncle Sam now owns 40% of the company.

I would go a step further and say that it should not be a stock purchase but partial nationalization. The government is not getting shares that will be sold later. The government is getting a right to appoint part of the board of directors. Every time the company issues a dividend, buys back stock, or engages in other activities to return value back to the shareholders, a proportional amount of money must be paid to the treasury. It only makes sense that if a company is so big that its failure is going to hurt society as a whole, it should be owned by society.

Fuck yeah! Their wealthy buddies would start bailing each other out if the alternative was the government buying the company at rock bottom and competing against everyone to build it back up.

The wrong way to take responsibility.

The good part is that the amd64 ISA is going to become less relevant if they go on like this. Maybe we’ll have those RISC-V PCs after all.

Management fucks up. Management loses money. Management cuts costs.

I plan on cutting intel out of my purchases for every single computer I make going forward. I bought an effected processor JUST before it came out that all their 13-14 gen processors will fall apart in just a couple months of use.

Planned obsolescence but it’s metastisized

When it was time to upgrade my PC awhile back it took me a long time to decide between the old school equal cores model and the new 12th-gen ones with BIG/little segregated core architecture. I wanted to future-proof my build so it would last a long time, but I chose the more conservative option of the old-school design for a number of reasons.

The Rocket Lake one turned out to be a great choice. I have 8 cores that can hit 5GHz and rock-solid reliability.

It’s kinda of odd watching the early 2000s amd repeat itself with intel

AMD didn’t ship defective CPUs.

True, I was more saying the decline, like lack of performance, hot as fuck chips etc

I think Intel needs to go through the humbling experience that AMD went through.

Hopefully AMD doesn’t pull an Intel and get complacent and spend over a decade doing basically nothing (at best) or or delivering subpar parts (at worst)

Honestly, I think AMD doesn’t even have the choice to be anywhere near as complacent as Intel.

ARM is on the rise, and that means multiple competitors incoming, both in the PC and console space.

Nvidia wanted to buy ARM, and despite that falling apart, Nvidia will be coming out with ARM CPUs (I imagine they’re, smartly, letting Qualcomm and MS sort out the teething issues with Windows on ARM before they swoop in and look polished and stable right out of the starting gate).

AMD also doesn’t have to pay a shitload to maintain, expand, and improve fabs - that’s all on TSMC. So the whole aspect of choosing between investing tens of billions or letting fabs stagnate isn’t a thing for AMD.

Yeah they could stay on the same process for 5 years, but I highly doubt they’d do that given the ARM competition, doubly so because they don’t want somebody else to take away their “we’re TSMC’s second favourites behind Apple” position.

In other words, I don’t think AMD has the financial incentive to stagnate like intel did. From a business perspective, it was an absolute no-brainer for Intel to stagnate; AMD’s comeback was an unlikely one. To date they’re the only company that’s recovered in the x86 space after falling back into complete irrelevance.

with all the controversies and court ruling against intel, do you really think… by this point, they are even capable of being shamed into being humbled?

CEO have himself a 45% raise last year. When do we eat the rich?

It should have been obvious when they brought Pat back.

Is this why my leaps all died?