“There’s this wild disconnect between what people are experiencing and what economists are experiencing.”

Based Nikki reminding us economists aren’t people

i am on board for the overall thesis of the article, because US consumer spending floats on easy credit and when there’s a credit crunch it compounds the effects of the inflation it was supposed to combat. people here buy money to buy everything and when buying money gets more expensive, everything goes haywire. some people cut back hard and some people borrow like it’s 2019 and then default. but this bit…

For Denise and Paul Nierzwicki, credit cards are the only way to make ends meet. The couple, ages 69 and 72, respectively, have about $20,000 in debt spread across multiple cards, all with interest rates above 20%.

The trouble started during the pandemic, when Denise lost her job and a business deal for a bar that they owned in their hometown of Lexington, Kentucky, went bad.

They applied for Social Security, which helped, and Denise now works 50 hours a week at a restaurant. Still, they’re barely scraping together the minimum payments for their credit card debt.

it goes on to say that they blame biden for this and are voting for trump because their credit card debt was only $10,000 when trump was in office. also, they think immigration is causing their problems. so basically, we’re dealing with a real brain trust.

there has got to be more to this story under the part about the “business deal went bad”. looking the guy up, he seems to be a realtor who bought a piano bar right after the global financial crisis (vulture!) and prior to had 10+ holding LLCs (a liability and tax dodging landlord move) which were dissolved in bad standing in 2008-2012. seems like a pattern with this guy. reads like they were trying to cash out of a big toxic asset (the bar) for a massive payday and, in standard realtor fashion, counted their chickens before they hatched and indeed borrowed in anticipation.

but anyway, working 50 hours a week to make minimums on $20k @ >20% is bankruptcy territory imo, but at least some kind of consolidation program if not a secured local bank loan against an asset or a balance transfer switcheroo. otherwise, that’s like $333/mo disappearing into a void, just to prevent the debt from growing and letting interest recapitalize. just thinking about that makes my stomach hurt.

my thinking, the story behind the story is that they are avoiding bankruptcy because they don’t want to sell their bar at whatever the current [lower] offer is and are trying to float their unstructured, high interest debts by forcing the elderly wife to wait tables 50 hours a week in the hopes that Daddy Deals can find a bigger idiot to buy his failed piano bar so they can ride off into their sunset years on a pile of money. that would explain not being able to consolidate or get a secured loan, because Mr. Real Estate Wizard leveraged the shit out of everything during the free money days. major small business tyrant sits on own balls vibes.

See this is why I don’t own a credit card because I don’t know what the fuck anything you said means. Im kidding kinda.

It’s fine so long as you make sure to

- not buy things you can’t pay off immediately

- pay things off immediately

I avoided credit cards like the plague until I turned 30 something. My partner coaxed me into getting my first one just to build my credit up, which I’m actually super glad for because my neolib credit score was so low I couldn’t even get a loan for a used trash car. I have 1 rule for my credit card and it is “the bill must be paid in full every month, no exceptions” and I have never bent that rule even once. Now my neolib score varies between excellent and very good boy depending on how much i use the card on any given month.

But doesn’t paying things off immediately negatively affect your credit score?

Carrying a balance on a credit card to improve your credit score has been proven as a myth. The Consumer Financial Protection Bureau (CFPB) says that paying off your credit cards in full each month is actually the best way to improve your credit score and maintain excellent credit for the long haul.

It’s not my business, but if you’re in the US you really ought to have a credit card unless you’re sure you can’t manage it. Credit score is interwoven into so much of life and the easiest way to build it is with a card. Plus you end up paying less due to cashback.

Damn I guess I need a credit card. What’s the best way to use it?

Buy things you can easily pay for every month and set up autopay so you never miss a payment. Get a card with cashback on groceries and do your groceries on it since you have to buy them anyway. If you cannot trust yourself with that do something like one low cost subscription on it.

Do not miss a payment, they will fuck you over and the interest on everything is insane.

I think I’m responsible enough, I’m in my late twenties and I’ve never felt the need for one, I’ve always just bought what I could afford.

get something that has no annual fee, for starters. nerdwallet has (or at least used to) have a good tool for looking at offers based on credit score, including options for people that have no credit history.

anyway, the main thing is to get something that is taken everywhere (not amex, not discover), gives you some kind of benefit (1% cash back?), and then use it for all of your purchases, and then pay it off completely each month. pay off the full balance, not just the statement balance. i have been using Mint to track my accounts, but that is going away and i haven’t figured out an alternative that meets my needs yet. it is very convenient and helpful to have an app on your phone that lets you look at your statement balance in real time and look at transactions. you can usually have it generate reports to see where your money is going. more importantly, it gives you peace of mind to know that if a fraudulent charge shows up, you can immediately call and have it flagged. though that’s rare. sometimes an app is offered by the credit card bank, but there are free alternatives.

anyway, open an account, stop carrying cash, and keep that account at $0. or, you can literally just activate the card and keep it in your sock drawer.

Thanks for the help I think I’m gonna look at what’s out there. I want to build up my credit because I need to get my wife a car eventually.

I don’t think so, that’s what I do and I have a good credit score

If you’re extremely consistent in paying off your balance every month, your credit score will still increase. Like yeah being a good debt customer looks better, but paying off your card and using it as a buffer against your checking account or bundle of cash in the mattress will cost you basically nothing because the interest never accrues.

it might make you a less attractive (read: profitable) credit card customer but shouldn’t impact your credit score itself, which is sold as a measure of likelihood of timely repayment

It might, but(Edit: apparently not, see above) it’s not like I’m ever going to be able to buy a place so it seems kind of irrelevant.

Having gotten one relatively recently it’s not as complex as you’d think… but then that just begs the question of what these people do to owe literally THOUSANDS, like I just pay my card off and don’t go into debt, it’s really that simple.

yeah, the credit card is a tool to make spending money easier. fraud protection on credit cards in the states is better than any debit card, so it’s more secure than any other option (cash, checks). make your selections, zip zap, the money moves. and the user can check their spending categories because there’s a record. i love that shit.

i think where it breaks down is how the time period between swiping and actually paying for the charge can decouple the two events in our minds. combine that with how crap wages are, driving down savings, and a sudden emergency expense (car repair) can give someone a balance, that is now taking on very high interest. if they can’t pay it off immediately, it now makes some other typical expenses take on interest as the balance is carried.

the “credit card float” is the term that the personal finance community uses for that window and makes a big point about making sure not to pay any utilities with a credit card, because it essentially keeps you “behind” on paying bills. it took me a bit to understand that conceptually, but the recommendation is to pay all bills/utilities straight from one’s bank immediately because if you lost your job/income, you wouldn’t still be on the hook for last month’s bills + this month’s at the same time. i know once i made that switch, i felt the bite of “catching up” immediately and realized how it was another trap and it wasn’t really adding convenience in the way swiping a credit card at a store does. not to mention, utilities are always hitting us with “convenience fees” anymore, lol.

i HIGHLY recommend having a credit card that doesn’t have any foreign transaction fees too in case you ever find yourself in another country. It makes everything SO much easier and you’re protected from the various scams you might run into as well.

They are 69 and 72. They have social security income. If they are smart, they’ve transferred all their assets out of their names, and now they are cashing in on their credit. If you don’t leave the world with an estate worth nothing and 7 figures of unrecoverable debt, then what are you even doing with your life?

They’re bad at business and they’re bad at personal management, and now they’ve lost it all and they’re blaming the president for the whole econony.

Rich people had more money when Trump was president, go figure.

This is just wrong.

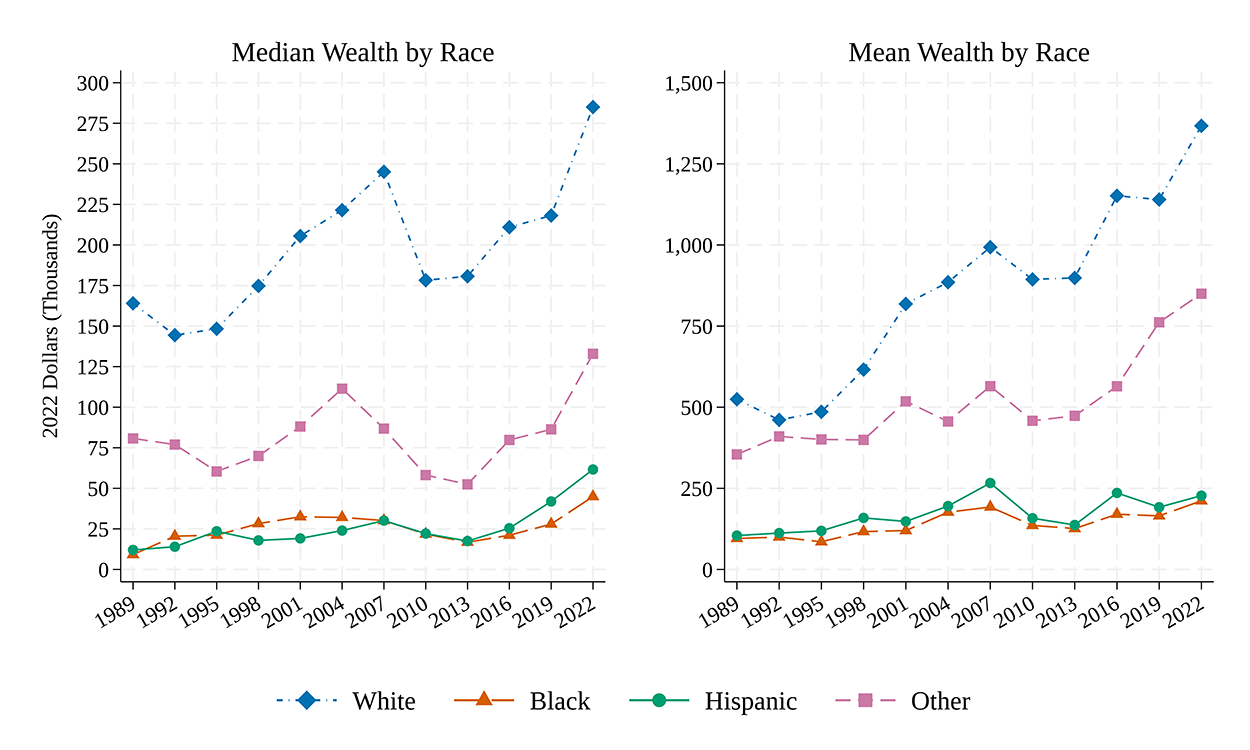

Source: Federal ReserveWhite family wealth gained a bit but remained stagnated under Trump. It shot up exponentially under Biden at the expense of all other races.

S&P500 is already 50% higher than its peak under Trump’s, and that’s just 3 years under Biden. Average housing asset value went up 36% from 2019 to 2022. That’s a huge amount of wealth increase in just 3 years.

Biden’s policies, especially its 5% interest rate hike, have been very specific about making certain demographics richer at the expense of the others.

There is no way that rich people had more money under Trump.

at the expense of all other races

The data does not really support this. All the lines go up from 2019-2022, especially the medians. Even the black and hispanic lines, that increased the least in absolute terms, are at or near their highest point since 1989 and saw some of their largest-ever gains since 2019.

This shows that white people have benefited disproportionally the last few years (as has long been the case, per the chart), but that everyone has benefited some. It does not show white people cannibalizing what everyone else has.

That’s still a big problem, but it’s more “the money spigot has historically benefited white people first and still did this time around” and less “Biden is taking from everyone else to give to white people.”

But the money spigot doesn’t come from nowhere - that wealth is generated by labor disproportionately completed by people of those two hyper exploited racial groups.

Even if the situation these people are is entierly pf their own making, usury is still a big problem.

certainly. 100% agree. i believe interest on loans is unethical. probably under an even slightly less absurd rent-seeking, predatory system than our own, the situation i believe they have created for themselves would not even be possible or would certainly be passively discouraged. the ideological frame of the petite bourgeoisie is not to do socially valuable work, but instead leverage one’s future to “invest” in scarce resources and corner some market. real estate in a densely populated area being a favorite. they internalize the idea that their capacity for risk is their capacity for success and the path into “success” which is entrance into the haute bourgeoisie.

of course, the haute bourgeoisie already has all the markets cornered and can wait out any deal while the petite bourgeoisie fatted sheep is sheared and slaughtered by their capitalist allies in the banks, pushing them to sell their position lower than they’d like. and this particular sheep, being devoured by the wolves, is crying out that problem is foreign sheep and how the wolves don’t have enough power.

Completly agree. These are perverse incentives. They never consider that the “risk” means a portion of them will be sacrificed.

I was listening to a show that had michel hudson the other day and he was talking about how it goes against the laws of thermodynamics. That you cant charge mere interest than a certain fraction of land yields or the society inevitably collapses, thats why most societies frowned upon the practice. And it was allowed on some ventures like trade expedition because it was asumed that most of them would fail and woulndt have to pay anything back.

I’ve got a friend who works for a real estate thing, think like “cash for ur shitty house” type company. He told me this story about a guy who was sitting on a house worth over 1.4M, then “a business deal went bad”, meaning he wasn’t paid out for his part of a business that was sold off. He ended up in 400k in debt, had tax liens on his house, the whole shebang. Now my friend’s company came in offering him 600k for the property to avoid foreclosure. it would have paid off the outstanding debt and tax liens but the guy wanted upwards of 800k. Now the lien has been sold at a tax auction and the dude is shit out of luck and will most likely have to declare bankruptcy. This seems to be a pattern of people who are so used to leveraging debt not being able to grasp the risk involved and think they can just wait it out and get the amount they want.

What also doesn’t add up is, at ages 69 and 72, they are just now applying for Social Security. You can take SS as early as 62 and the longer you wait the higher your payment is, but this stops at 70 and the advice given most normal people is to start taking SS between 62 and 65. Only people I have seen wait to 70 are high net worth people.

no doubt. I plan to start “retirement” at 62 for sure, but my only uncertainty is healthcare between 62 and 65, which is when Medicare starts.

elsewise, my goal is quit as early as possible and figure out how to get by on whatever I get. I feel like people who want to retire with big bucks are nuts. what a gamble!

What is the tax advantage of the holding LLCs? Is it some state tax thing? For US federal income tax purposes, assuming these were wholly owned, they would be disregarded entities.

My wife likes to watch these financial youtubers and she found a guy that interviews Americans and they end up with like 30 - 100k in credit card debt, which promptly puts them in “paycheck to paycheck” status. I really appreciated Hell of Presidents looking at the two paths American presidents offered the American people. Carter with “adopt a prayerful and spartan lifestyle” and Reagan “Accumulate debt and pretend everything is okay”.

It gets so tiring having to explain to older people that in their words “assets increasing in value” is a BAD thing.

Um, stupid commie, have you actually even considered that number go up? Checkmate.

My parents are planning to retire soon, and part of their retirement plan is selling their house to downsize into a space that’s better suited for their old age. Unfortunately none of their kids can afford to buy the house for market price, but they won’t be able to retire if they wanted to sell it at a discount to any of us. We’ve had a lot of difficult conversations lately where I encourage them to stick to their retirement plans while explaining to them that us kids likely won’t ever be able to afford our own places, ever

Between you and me, I’m just half-considering what it would be like to leave the US entirely. I know many other countries have a slew of problems, but its obvious that the US is an ancap shithole. The wealthy are the only “real” people, and we’re just cattle that they always foot the bill to for everything all the damn time, and we’re told that we’re ‘entitled’ for not liking it.

30-something renter (me) says economy doesn’t add up: “I’m making the most money I’ve ever made, and I still can’t qualify to buy a house”

why aren’t I allowed to get a mortgage that is lower than the average monthly rent I have to pay anyway!?

Maybe you can get a mortgage with PMI. They have some out there that are reduced money down.

iirc less than 20% down is doable with mortgage insurance

same… we may an obscene amount of money for rent but can’t get a mortgage for even 3/4 of that amount

Does she purchase soy lattes and avocado toast by any chance?

I ordered an avocado and toast in 2008 and still haven’t financially recovered.

my girlfriend and I are both making more money than either of us have ever made, but there is a 0% chance we’ll own a house

this is how California rolls

Same here, I’m likely moving with my wife and kid to another state this year in the hope of us being able to not have to live in a 1 bed apartment, but….my employer has stated they’ll cut my wages by 30% if I do

we considered it too for a while but would suffer the same penalties… we both would have lost 30% at least and then I ended up leaving my job anyway and now i have to work at least 3 days onsite so here we remain for now

that’s right baby i’m making more money than i’ve ever made as a renter but can’t afford a studio or 1br apartment anywhere

I’m making 60% more than I was in 2022 and yet I’m only barely saving more. It all gets eaten up at the fucking grocery store

‘Pour calmer tes envies d’holduper la caissiere…’

Origin of quote below

spoiler

- ‘Degeneration’, a song by ‘Mes Aieux’

deleted by creator

deleted by creator